new mexico gross receipts tax due date

Due Date Extended Due Date. If the 25th falls on a weekend or holiday the transaction must be completed on the first business day.

Gross Receipts And Property Tax Ppt Download

Q1 Jan - Mar April 25.

. Q3 Jul - Sep October 25. 6 New Mexicos own economic nexus threshold for the GRT took effect on July 1 2019. Hearing scheduled April 29 on new Gross Receipts Tax regulations Department begins issuing special 600 rebates Appointments available at MVD due to expanded capacity.

By Finance New Mexico. Latest News View Our Most Popular Pages. Just now the new mexico trd.

For monthly gross receipts tax filers gross receipts tax returns due August 25 will be the first gross receipts tax report using the new sourcing rules. BOR 67-2 NM Gross Receipts and Compensating Tax Regulations September. 6 also contained a second set of significant GRT changes that will go into.

The tax is due on the 25th day of the month following the month of production unless otherwise authorized by the Department. Quarterly the 25th of the month following the end of the quarter if combined taxes for the quarter are less than. Hearing scheduled April 29 on new Gross Receipts Tax regulations Department begins issuing special 600 rebates Appointments available at MVD due to expanded capacity.

HISTORY OF 322 NMAC. There are two deadline requirements to consider. Filing statuses for gross receipts tax and their due dates are.

Under the new rules most. Hearing scheduled April 29 on new Gross Receipts Tax regulations Department begins issuing special 600 rebates Appointments available at MVD due to expanded capacity. Q4 Oct - Dec January 25.

24 December 28 2021. Your New Mexico state gross receipt tax returns and payments are due on the 25 th of the. Earlier today the Taxation and Revenue Department updated a key publication providing guidance on Gross Receipts Taxes GRT with new information on.

New Mexico Gross Receipts Tax Filing Due Date On april 4 2019 new mexico gov. For sales made on and after July 1 2019 a remote seller must register with the state then collect and remit New Mexico gross receipts tax if gross revenue from the sale of taxable tangible. You continue to the most current city during office during a due dates for nm gross receipts tax laws and carry a due.

For all CRS taxpayers the deadline for filing the CRS-1 Form online including remitting any tax due via electronic check or. New Mexicos gross receipts tax is admittedly confusing but the state still expects businesses to follow the law and pay what they owe from. Making payment of a gross receipts tax new mexico due date falls on our advertisers and costs must i have several credits.

Current through Register Vol. Your new mexico state gross receipt tax returns and payments are due on the 25 th of the month following the close of the period in question. Q2 Apr - Jun July 25.

In New Mexico you will be required to file and remit sales tax either monthly quarterly or semiannually. July 7 2021. New Mexico sales tax returns are generally always due the 25th day of the.

Recycling Center Local Events.

Stephanie Schardin Clarke Schardinclarke Twitter

New Mexico Sales Tax Guide And Calculator 2022 Taxjar

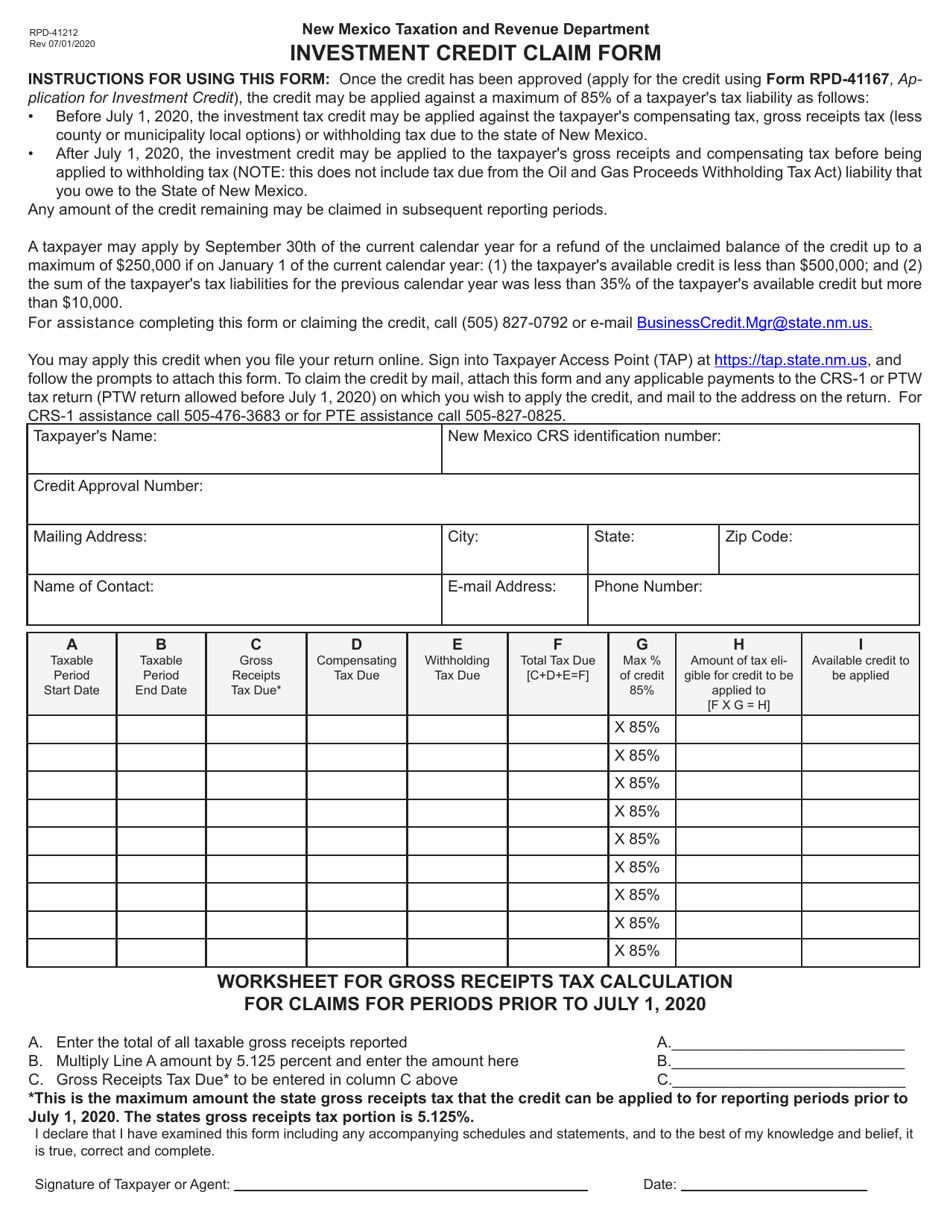

Form Rpd 41212 Download Printable Pdf Or Fill Online Investment Credit Claim Form New Mexico Templateroller

New Mexico Increasing Tax On Services Changing Sourcing Rules

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

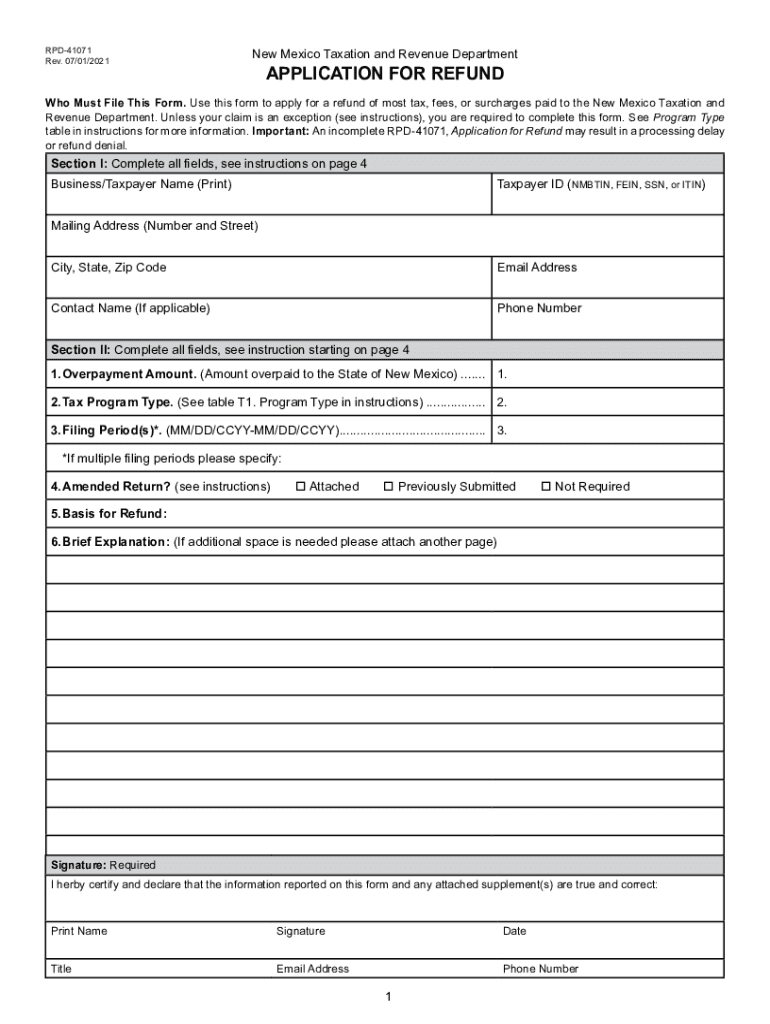

Rpd 41071 Fill Out Sign Online Dochub

New Mexico Tax Research Institute State And Local Revenue Impacts Of The Oil And Gas Industry New Mexico Oil Gas Association

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Short Form For 3 Or Fewer Business New Mexico Templateroller

Fillable Online Test Trd Newmexico Fyi 202 Gross Receipts Tax And Health Care Services Test Trd Newmexico Fax Email Print Pdffiller

How To File And Pay Sales Tax In New Mexico Taxvalet

How To File And Pay Sales Tax In New Mexico Taxvalet

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

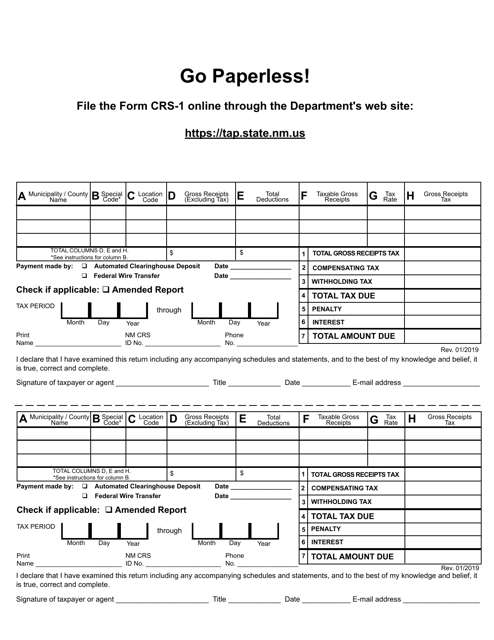

Crs 1 Short Form Crs 1 Combined Report Short Form For 3 Or Fewer Business Locations Codes Or Lines Of Detail

New Mexico Proposes Digital Advertising Services Gross Receipts Tax Regs

Get A Handle On Gross Receipts Tax If Doing Business In New Mexico Resource Tool For Start Up And Small Businesses In New Mexico

Attn All Airbnb Hosts Re Gross Receipts Tax And L Airbnb Community